Jul 27

2009

Like all living things, companies thrive and prosper when theyíre part of a diverse ecosystem that provides the right infrastructure for sustained growth and development.

Internet and software ecosystems are interesting because they are usually formed around the initial success of a single company that emerges from a highly competitive environment. If this company can nurture and grow this initial ecosystem, they enjoy a significant competitive advantage that eventually leads to market domination.

For example, Microsoft became a monopoly due to their success with the Windows software ecosystem. Google is effectively a monopoly with their AdWords/AdSense SEO ecosystem enabled by their successful search engine algorithms. Weíre now starting to see companies like Facebook and Twitter parlay their initial success into the development of ecosystems around social applications.

Therefore, itís important for companies to pay attention to developing ecosystems instead of just focusing on improving their own products and services. When it comes to Internet ecosystems, there are Six Dís that have a big impact on the development and success of the ecosystem:

You cannot have an Internet ecosystem unless you have developers. Itís obvious, but many companies never prioritize the importance of developers. Internal groups that advocate on behalf of 3rd party developers usually have limited influence and cross-functional visibility over divisions. To ensure a thriving ecosystem, companies must ensure that critical internal organizations have an important role and stake in the growth of the developer community.

Once you have developers, you need development platforms and tools that are aligned with the needs of the developer community. This means opening up the right set of APIs, providing development environments and tools that enable high developer productivity, and an online community for sharing best practices. This also requires Internet companies to balance their need to protect their core intellectual assets and user base against the need to open up their platform to 3rd party developers.

With Internet services, many developers face challenges in building out a solid deployment infrastructure that can be scaled, secured, and evolved over time. Since many developers face similar challenges and issues, this provides a perfect opportunity for Internet companies to take a leadership position in facilitating or even developing deployment and scaling infrastructure solutions that are tailored to the needs of the ecosystem.

Dependability is critical for an Internet ecosystem because it is the trust that binds the ecosystem together. Companies that anchor an ecosystem need to provide clear community leadership with guidelines for acceptable behavior and engagement models for all parties involved, including themselves. They also need to provide a dependable platform that will perform and scale with the growth of the ecosystem.

An ecosystem with a thriving distribution channel that ensures discovery of great applications by end users is the critical growth engine behind an ecosystem. Internet companies must take a proactive leadership position in creating and investing in a distribution channel for 3rd party developers. This is a critical area where even a small investment can pay huge dividends for everyone in the ecosystem.

Ultimately, the success of an ecosystem will depend on the ability to deliver real value to end users and meaningful revenues for developers in the ecosystem. Many Internet companies take a sink of swim approach to revenue for others in the ecosystem and solely focus on growing their own revenues. Instead, they need to focus on creating a synergistic revenue stream that focuses on growing revenues for the entire ecosystem.

Given these Six Dís, itís interesting to use this model to examine how some of the leading Internet companies are building the next great ecosystem:

Out of all the companies, Facebook stands out because of their innovation in development tools and distribution channels. The Facebook platform provide an easy entry point yet it has enough power and flexibility to enable developers to take full advantage of the viral distribution channels enabled by a social graph. Also, the Facebook ecosystem is starting to generate meaningful revenue for top developers without much support from Facebook. With investments in revenue generation infrastructure and further innovation in distribution channels for 3rd parties, Facebook is well positioned to create the next great Internet ecosystem.

Twitter has the beginnings of a great ecosystem. Despite the simplicity, or maybe because of the minimalism of Twitter, there is a lot of excitement and creative ideas on expanding the platform from 3rd party developers. Twitter has great potential but they are being held back by the lack of a clear strategy that addresses Distribution and Dollars. To ensure the long term success of Twitter as an ecosystem, they must develop a viable distribution channel and foster the development of revenue streams for themselves and for 3rd party developers.

Google shows great promise because it has products and services that cover all the Six Dís. The only thing missing is a top down strategy that ties all these elements together. Also, given their highly monetizable search and advertising ecosystem, their innovatorís dilemma does present challenges in expanding into new areas. Despite these challenges, Google financial resources and engineering prowess means that they have great potential to evolve their current ecosystem into an even more dominant Internet ecosystem.

Microsoft is the most hampered by the innovatorís dilemma because they have the most to lose with the transition from software products to Internet services. They have had some success in building out their Internet ecosystem with developers and development tools but they lack a strong Internet presence that can form the basis of an Internet ecosystem. To catch up with others, Microsoft will need to take an M&A approach to building out an Internet ecosystem.

Yahoo is a great example of a company that is paying the price for not leveraging their initial success and building out a robust ecosystem. Yahoo focused on becoming a destination site and never made a serious investment in any of the Six Dís. To their credit, Yahoo still has a tremendous online presence and they will make an attractive acquisition target for others looking to build out an Internet ecosystem.

These are just some of the companies that have the potential to build the next great ecosystem, but there will be others. Weíre still in the early stages and it will be exciting to watch these companies deal with changing market conditions and new startups that challenge the status quo.

Personally, I think weíre at a very interesting point in the evolution of the Internet. Companies like Google and Amazon are currently leading the way in monetizing the Internet revolution enabled by companies like Netscape. These companies all succeeded via business model innovation enabled by product and technology innovation.

With the emergence and initial success of Facebook and Twitter, weíre seeing the next wave of innovation. The next wave will be based on innovations around social and business interactions enabled by the mapping of personal and professional relationships in a Social Web. The winners in this wave will not be determined by product and technology innovation per se, but by the creation of rich and diverse ecosystems around the Social Web.

Jan 13

2006

The best business books have a profound yet easy to understand insight based on a simple observation. The Innovator's Dilemma is one of those books. It is also one of the best examples of why there is always hope for startups in the technology space, even when competing against market leading companies.

The best business books have a profound yet easy to understand insight based on a simple observation. The Innovator's Dilemma is one of those books. It is also one of the best examples of why there is always hope for startups in the technology space, even when competing against market leading companies.

Clayton Christensen makes the observation that even when market leading companies do everything right, they eventually lose their leadership position due to some unforseen and disruptive product, technology, or business model. It's a form of corporate Darwinism where every company has its demise encoded into its DNA. Companies might be able to adapt to changing market conditions, but if you're a dinosaur that needs a lot of food for sustenance, you are not going to survive the Ice Age. You have to become a bird and compete with other smaller animals used to surviving on less food.

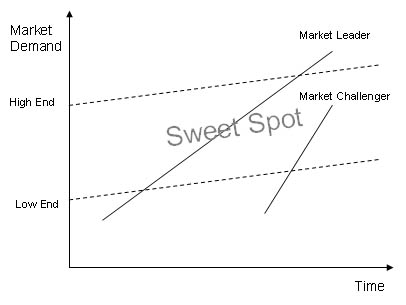

The observation is very simple but the interesting insight from the book is analyzing why leading companies have this predictable lifecycle. Essentially, the insight can be summarized in one simple graph:

The graph shows how all markets have a sweet spot that is bounded by low end demand and high end demand. Companies start out by barely meeting the demand from the low end and then continue to innovate themselves into the sweet spot. They then continue the innovation until they innovate themselves out of the sweet spot.

Why do companies do this? It's obvious to anyone who has worked at a large company. Every product manager's dilemma is the balancing act of satisfying requirements from large customers with risky innovation that allows them to offer new products and enter new markets. To satisfy the need for revenue growth and earnings targets, the tendency is for companies to direct their resources to satisfying their larger, more visible customers who bring in the quantifiable and recognizable revenue.

In the software industry, there's another good reason for this behavior. Since software is not a recurring revenue product (unless it's a Software as a Service solution), companies need to keep introducing new features to drive revenue via product upgrades. The classic example of this corporate behavior is Microsoft with Microsoft Office. Your typical user of Microsoft Office is unaware of the many advanced features, yet power users continue to drive demand for even more advanced capabilities.

When market leading companies fall into this trap of over-innovating on their innovation trajectory, it creates an opportunity for smaller and nimbler companies with faster innovation trajectories. These companies will start out with less features, but given their faster trajectory, they will catch up to the sweet spot with a more compelling product and disruptive business model. The current example of this phenomeon is what is happening in the CRM space with Siebel and Salesforce.com. Siebel still has the superior product but Salesforce is making significant inroads based on the combination of usability innovation, software delivery innovation, and a disruptive business model. There are many others historical examples as well as emerging examples with companies such as Writely and Numsum that are going up against the Microsoft Office franchise.

So, what does all of this mean for Startups? The Innovator's Dilemma provides real hope for Startups when competing against much larger established companies. It provides an analysis of how market leading companies fail and it backs up the analysis with historical case studies across several high tech industries. Even the largest, most successful companies can be undermined by the right Startup with the right mix of product, business strategy, and execution.

The other useful insight that you can derive from the Innovator's Dilemma are guiding principles for Startups when attacking a market leader. Here is my take on the top three things that Startups need to keep in mind when exploting the Innovator's Dilemma of a market leader:

- Start at the Low End

Trying to go after the high end of the market is a losing strategy for Startups. Startups will find it difficult to compete in the high end market with high end features, given the company maturity, market presence, and engineering resources. Startups are better off competing in the low end of the market and niches ignored by the market leader. - Innovate and Differentiate

Startups need to have a faster innovation trajectory to enter the sweet spot and catch up to the market leader. The only way to get a faster innovation trajectry is to truly innovate and have a differentiated product with a compelling value proposition. Copying or emulating the market leader will not be enough. - Lead with a Disruptive Business Model

A disruptive business model is the best weapon for a Startup when competing with the market leader. Large companies have significant challenges and inertia when it comes to changing business models that have made them the market leader. Startups do not have this issue so disruptive business models always benefit the customer and Startups as long as the model is sustainable and profitable.

I'm sure there are others, so feel free to drop me an email or blog about this entry on your own blog.

Jun 08

2004

There is a lot of useful information here, and my understanding from Jeff's notes is that service oriented flexible computing is about server side distributed computing. The conference seem to focus on the shifts that are going to occur in the software, hardware, and network layer as a result of this shift in computing architectures. This shift has been happening for some time and there are companies attacking the network, hardware, and systems software (ie. grid computing) side of the problem. However, I don't see how this is all going to work until you address the higher level integration and implementation of business processes in a service oriented architecture.

You can have the flexibility in network infrastructure, distributed storage and computing cycles, and distibuted web services, but you still have to link and orchestrate flows of information across this architecture to implement business processes. Providing tools and standards to make this orchestration happen is not an easy problem. Maybe this will be addressed in day 2 of the conference. I hope Jeff continues to write about it on his blog.

Feb 02

2004

The topic that I found to be most interesting in Paul's talk was his discussion of the technology adoption S-curve. Bascially, if you look at the rate of technology adoption, it looks like a horizontally stretched "S" when you map adoption/penetration on the Y-axis and time on the X-axis. What this means is that when a technology is first developed, it takes a while for either the technology or market conditions to develop to the point where it hits an inflection point and achieves rapid adoption. Eventually, you reach market saturation and then the curve flattens out. Some examples that he cited include the mouse which was invented by Doug Engelbart in 1968 while he was at SRI. It was only in the late eighties/early nineties that the mouse really took off with the arrival of the Macintosh and Windows. Other examples included pen computing which was around in the eighties with Go and Apple's Newton but only took off with Palm in the nineties.

So, how does this all relate to where we should be investing our energy, time, and money?

What the S-curve means for an entrepreneur or VC is that you want to be at the inflection point of the S-curve, not at the beginning or the end. An important corollary from this statement is that you should build companies on technologies that have been around for a while but have failed to achieve significant adoption. As an enterpreneur, you need to identify opportunities where there is significant innovation or where there is a change in market conditions/infrastructure that enables the rapid mass market adoption of a promising technology.

Of course, not every technology is going to achieve mass market adoption and have a tall S-curve. The difficult part is identifying technologies that hold enough promise to achieve mass market adoption with additional innovation and changes in market conditions/infrastructure. However, I think the advice of looking for the next big thing among the failures is very good advice. After all, Silicon Valley's success has and will be tied to the continuous failure/success cycle of its technologies and entrepreneurs.

Anyone interested in taking bets on the next big thing being the return of mainframe computing, client/server, push, or selling pet food over the internet?

Feb 19

2003